Let’s be honest: nobody actually wants to spend their Sunday evening categorizing grocery receipts into an Excel spreadsheet. I work in finance, I love data, and even I find traditional budgeting incredibly tedious.

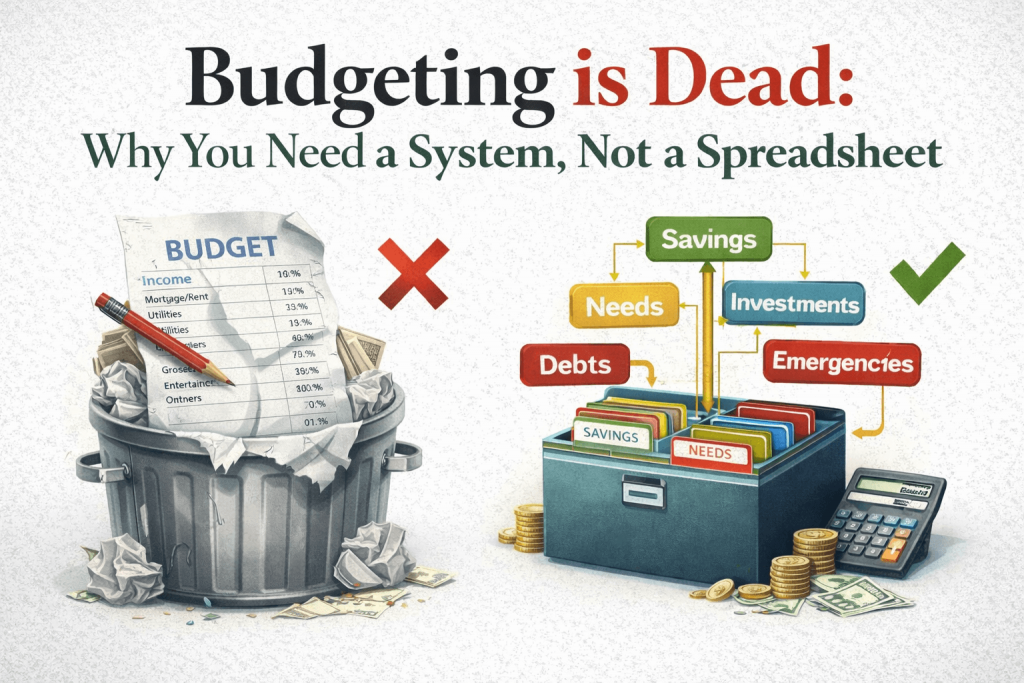

If your financial plan relies on 100% willpower and manual tracking, it is designed to fail. Life happens. You get tired, you get busy, and you stop updating the sheet. That’s why I stopped “budgeting” and started building a system.

The Failure of Willpower

We have a finite amount of willpower each day. Using it to decide whether or not you can afford a £4 coffee is a waste of mental energy. The goal isn’t to think about money more; it’s to think about it less, while knowing that everything is taken care of.

The “Set and Forget” Framework

My “No-BS” approach to financial automation involves three simple steps to take the decision-making out of your hands:

- The “Pay Yourself First” Trigger: Set up a standing order that moves your savings and investment contributions to a separate account the exact same day your salary hits your bank. If you never see the money in your main account, you won’t miss it.

- Guilt-Free Spending: Once your savings, rent, and bills are automated, whatever is left in your account is yours to spend. No guilt. No tracking. Whether it’s a night out or a new pair of shoes, if the money is there, it’s fair game.

- The “Peace of Mind” Buffer: Maintain a small emergency fund (I recommend £1,000 to start) in a completely different bank. This isn’t for investing; it’s a psychological “firewall” so a flat tire or a broken laptop doesn’t ruin your month.

Focus on the Big Wins

People spend hours trying to save £10 a month on Netflix but ignore the fact that they haven’t negotiated their rent or moved their savings to a higher-interest account.

I’m a firm believer in the 80/20 Rule: Focus on the 20% of actions that drive 80% of your results. Automating your investments and cutting costs on things you don’t care about (like bank fees or unused subscriptions) matters infinitely more than counting pennies.

The Bottom Line

A good financial system should be like a good OS—it runs in the background, keeping everything stable while you focus on the “apps” (your career, your hobbies, your life).

Don’t be a slave to a spreadsheet. Build a system that sets you free.